A Few Lessons For Investors And Managers From Warren E. Buffet

Author: Peter Bevelin

Published: 2012 (81 pages)

Started reading: 25.December.2016

Finished reading: 9.January.2017

Brief description

A Few Lessons for Investors and Managers from Warren E. Buffett by Peter Bevelin is a collection of thoughts from one of history’s most successful investors (“one of”, because, on certain metrics, some have considered Carl Icahn to be better).

A Few Lessons For Investors And Managers is a smorgasbord of Buffett quotes, shining a light down the rabbit hole of investing

A prominent theme accompanying nearly every line is that successful investing needs supreme mental discipline. Buffet’s allegedly superhuman rationality is what sets him apart from most other investors. Admittedly, he now commands the vast analytical prowess of Berkshire Hathaway, but his original advantage as an investor, to my lights, has been a behavioural one.

For example, Buffett is an enthusiastic advocate of studying harm, so that he knows what to avoid. At its most basic, his investing philosophy is about minimising the chance he’ll make a bad deal (“to finish first, you must first finish”). Buffett keeps strictly within his “circle of competence”, meaning that he diligently refrains from investing in companies that he knows nothing about.

“Nothing sedates rationality like large doses of effortless money. After a heady experience of that kind, normally sensible people drift into behaviour akin to that of Cinderella at the ball. They know that overstaying the festivities – that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future – will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There’s a problem though: They are dancing in a room in which the clocks have no hands.”

-Warren Buffett, Letter to Shareholders, 2000

A Few Lessons for Investors and Managers from Warren E. Buffett represents a collection of Buffet’s insights – many of them highly quotable, thanks to the man’s aphoristic tendencies – taken from his annual letters to shareholders or from An Owner’s Manual, Berkshire’s philosophical pamphlet.

Bevelin – a man I know little about except that his wife sketched the portrait of Buffett on the book’s front cover and that he has also published a book on Buffett’s right-hand man, Charlie Munger – has organised these quotes into Chapters including “Valuation”, “Business Characteristics: The Great, the Good and the Gruesome”, and “Management Compensation: I Get What I Reward For”.

So what types of companies does Buffett invest in? It is perhaps more instructive to ask: What doesn’t he invest in? As the book makes clear, he avoids investing in businesses selling commodities (“it’s impossible to be a lot smarter than your dumbest competitor”) and retail or hospitality (“I-have-to-be-smart-every-day-business[es]”). He and Munger prize companies that have a “moat” – or durable competitive advantage – that are simultaneously under-valued and run by ethical managers.

“Business experience, direct and vicarious, produced my present strong preference for businesses that possess large amounts of enduring Goodwill and that utilize a minimum of tangible assets.”

-Warren Buffett, Letter to Shareholders, 1983

Buffet and Munger also explicitly stay away from technology businesses. The reason for this is that they prefer only to invest in companies whose products they personally understand – this allows them to assess the presence and quality of the “moats”. Neither Buffet nor Munger is a scientist, so they leave complex tech to more audacious peers.

As such, Silicon Valley angel investor Marc Andreessen of Andreessen & Horowitz has suggested Buffett’s career consists in betting against the future. Certainly, his recent efforts in hampering the progress of solar energy in Nevada to favour his own companies would suggest he subordinates progressive concerns to the game of investing. Although this isn’t to say he isn’t altruistic: his decision to pledge most of his wealth to the Bill and Melinda Gates Foundation is not insignificant. It could just be that Buffett’s conception of what-it-means-to-make-a-positive-contribution-to-humanity looks like philanthropy, rather than the Elon Musk model of directly building a better future.

“At Berkshire we make no attempt to pick the few winners that will emerge from an ocean of unproven enterprises. We’re not smart enough to do that, and we know it.”

– Warren Buffett, Letter to Shareholders, 2000

Buffett’s avoidance of tech companies is curious for another reason: does he simply lack the technical expertise, unique connections or visionary brilliance of Silicon Valley investors like Chris Sacca, Marc Andreessen, Ben Horowitz, or Peter Thiel? Perhaps he finds it safer and easier to put his money with uninspiring companies like Heinz and See’s Candies. Or are those famous tech investors simply lucky, examples of the survivorship bias and beneficiaries of the feedback loop that dominates venture capital, whereby the most successful investors are approached by the most promising entrepreneurs?

It certainly helps to be in the top echelon of VC firms if you’re looking for massive returns. And it helps to be in the right place at the right time, like Thiel and Reid Hoffman were with Facebook. But despite Buffett’s example, humble investors like me still have a lot to gain, I believe, from tech and biotech companies, if we play the barbell strategy outlined by Nassim Taleb in the Incerto.

Buffett still lives in the modest Omaha home he bought in the 1950s. A great example of ‘counter-signalling‘: if you’re one of the richest people on earth, you don’t need a fancy mansion to prove it. People prone to outward demonstrations of wealth tend to be lower down the pecking order.

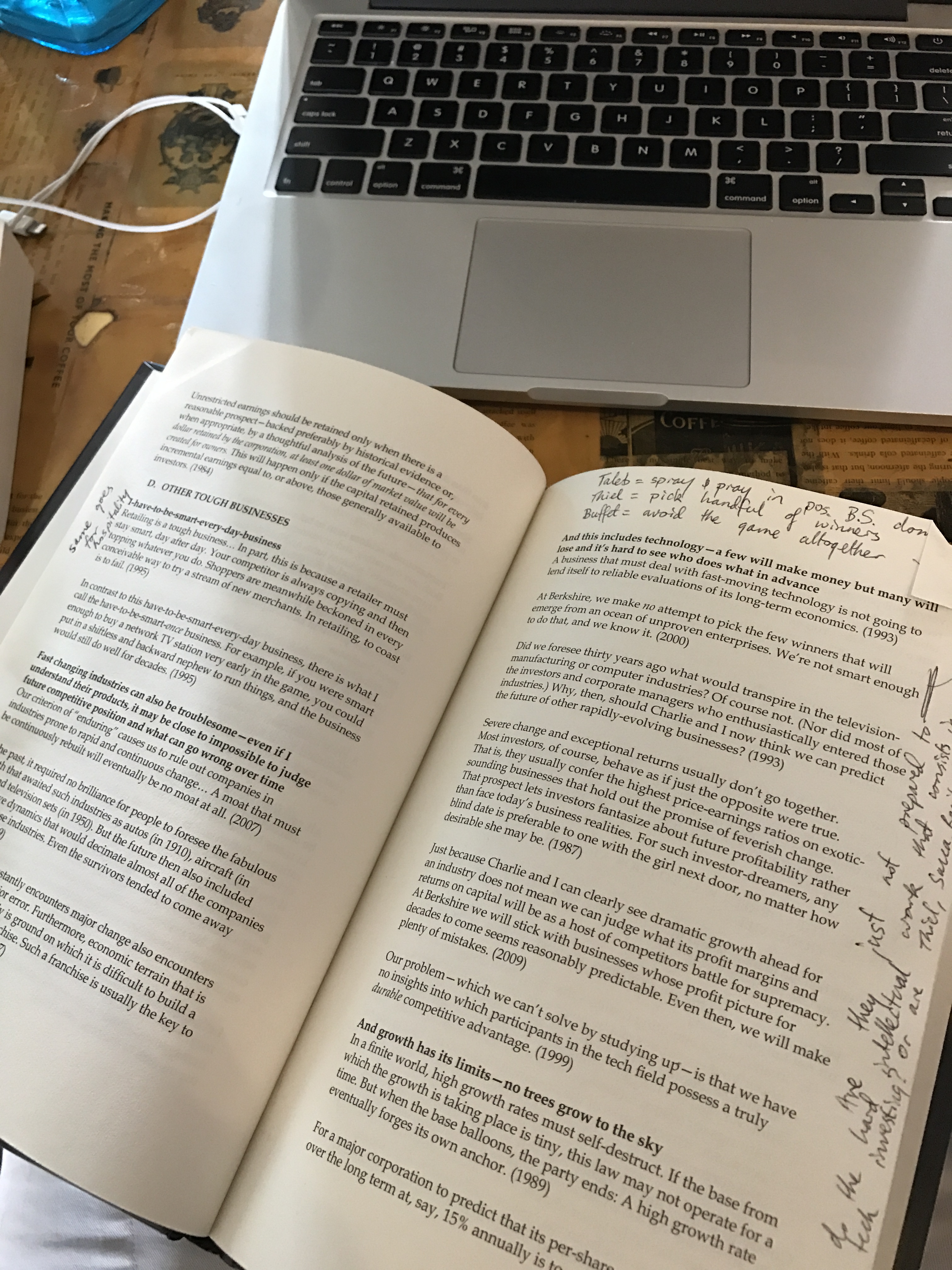

The key – and for me not fully resolved – question is whether it’s better to allocate small bundles of money to a large swathe of companies, as Taleb advocates (“spray and pray”), or to carefully pick a small handful of companies and go in hard on each, as Thiel argues in Zero to One. Interestingly, both Taleb and Thiel suggest their approach is an implication of the fact that the distribution of returns for tech companies follows the power rule. This is certainly an issue that requires further thought, but the answer won’t lie with Buffett: he is, ultimately, too disciplined to engage in the risky business of tech investing.

But, of course, there is still much to learn from him. While my description of Bevelin’s book has thus far painted a picture of a fairly common sense business manual, there’s enough technical advice in the book that more experienced investors will find it valuable.

For example, it contains information on why it’s essential to select board directors for their business judgement rather than factors such as diversity; why acquisitions are often a bad idea for the purchasing company; as well as other tips such as, when considering the growth rate of a business, paying particular attention to which beginning and terminal years were selected and why. It’s always cool to read the tips of a master, no matter the field.

Actionable Insights

> Resist action bias. There may be a temptation to “do something”, to invest, even for marginal returns, if you are long on cash, and especially if you are suffering “fomo” (“fear of missing out”). Action bias is a systematic human tendency. It should be assiduously avoided in the investing context. As Buffett says, it’s better to wait, with a loaded gun, for rare elephant-like opportunities, than have no bullets in the chamber because you’ve lost them or wasted them on smaller fare. Cash is optionality; inactivity can be intelligent.

> Value the ethics factor. Buffett emphasises the importance of not investing in companies with morally dubious managers – this is a real risk that applies to investing as it does to business deals more generally. Work with ethical people, because they won’t screw you over. The reason I’ve included this advice here is that it often seems like an after-thought in the cut-and-thrust of the business world, so I was taken aback by how importantly Buffett stressed it as a consideration in all his dealings. I get the feeling that it’s easy to underestimate the importance of ethics until you’ve been personally burnt – think of all those unlucky souls who invested their money in Enron.

“There’s plenty of money to be made in the centre of the court. If it’s questionable whether some action is close to the line, just assume it is outside and forget it.”

-Warren Buffett, Memo to Berkshire Hathaway Managers, 2010