Zero to One

Author: Peter Thiel

Published: 2014 (195 pages)

Started reading: 21.July.2016

Finished reading: 25.July.2016

Brief description

Start a mobile app, cool restaurant or clickbait website and you’ll be taking civilisation from 1 to n.

Start something categorically new and we’ll be going from 0 to 1.

As PayPal co-founder, Palantir co-founder and Facebook‘s first investor Peter Thiel writes in Zero to One: Notes on Startups, or How to Build the Future, “The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. If you are copying these guys, you aren’t learning from them.”

Zero to One is a compendium on startups and civilisational advancement, based on a series of lectures Thiel delivered at Stanford in 2012.

Thiel covers off on diverse topics like founder’s personality traits, a checklist for venture capitalists, the importance of the ‘definite optimist’ outlook, distribution models for startups, and a brief history of the dot.com boom.

Two core insights underpin the book.

> New technology is what enables vertical progress or 0-to-1 transformations. Globalisation ( for example, China replicating the US) is more of a 1-to-n transition.

> Monopoly, not competition, is the best model for delivering transformative technologies. Monopolistic companies understand a ‘secret’ or contrarian truth about the world that others don’t. What enables their domination – the ‘secret’ – is the same thing that creates radical progress. Moreover, monopoly profits free up a company to focus on its mission rather than only on the bottom line (think Google X).

Thiel is a contrarian, and as a former lawyer his opinions are well-reasoned. Yet argument by example creeps into some of his musings, such as his impressions of founders’ traits and his preference for monopolies. Zero to One should thus be read as a philosophical framework for understanding startups and the future. Don’t expect impeccable rigour.

Peter Thiel made the weird decision to speak in favour of Donald Trump at the 2016 RNC

Actionable insights

> To create a monopolistic company, don’t try to be all things to all people. Rather, dominate a small market, then spread outwards from there. Thus PayPal began with eBay users and Facebook with Harvard students. The reason why starting small is essential has to do with distribution.

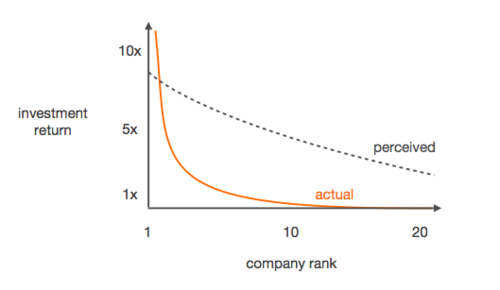

> If you’re VC or startup investor, the ‘spray and pray’ approach will fail. The correct method is to invest in a handful of carefully researched, potentially monopolistic companies. Spray and pray fails because success distribution conforms to the ‘power law’, which is a more extreme version of the 80/20 principle.

How venture capital portfolios will actually perform vs perception