#99: Housing Bubble Week Epilogue: Not All Bubbles Are Created Equal – Vernon Smith

2 min read

Vernon Smith won the Nobel Prize in Economic Sciences in 2002.

Show notes

Charts

Selected links

- Follow Vernon: Website

- Rethinking Housing Bubbles, by Vernon Smith and Steven Gjerstad

- ‘Debt Deflation: Theory and Evidence’, address by Mervyn King

- ‘Is the 2007 US Sub-Prime Financial Crisis So Different? An International

Historical Comparison’, paper by Rogoff and Reinhart - ‘Global Household Leverage, House Prices, and Consumption’, FRBSF Economic Letter by Reuven Glick and Kevin Lansing

- ‘Dealing With Household Debt’, chapter by the IMF

- ‘The great mortgaging: housing finance, crises and business cycles’, paper by Jorda, Schularick and Taylor

- ‘Leveraged bubbles’, paper by Jorda, Schularick and Taylor

- ‘Housing and the Economy’, 2019 speech by Guy Debelle

- ‘Bubbles, Crashes, and Endogenous Expectations in Experimental Spot Asset Markets’, paper by Vernon Smith, Gerry Suchanek and Arlington Williams

- A Life of Experimental Economics, Volume I, by Vernon Smith

- The example scenario of pessimists and optimists buying 100 identical houses is from House of Debt, by Amir Sufi and Atif Mian

- ‘The Leverage Cycle’, paper by John Geanakoplos

- ‘Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment’, paper by Brad Barber and Terry Odean

- The Wisdom of Crowds, by James Surowiecki

- ‘The Clinton Housing Bubble’, WSJ article by Vernon Smith

- ‘‘We’re heartbroken’: home in same family for 93 years passes in’, 2018 The Daily Telegraph article

- ‘Why are we so worried about household debt?’, article by Stephen Koukoulas

- ‘Public perceptions of foreign and Chinese real estate investment: intercultural relations in Global Sydney’, paper by Dallas Rogers, Alexandra Wong and Jacqueline Nelson

- A Monetary History of the United States, by Milton Friedman and Anna Schwartz

- ‘The Debt-Deflation Theory of Great Depressions’, paper by Irving Fisher

Topics discussed

- Vernon’s childhood, growing up in the Great Depression. 16:44

- How did Vernon choose to go to college? 21:10

- What does Vernon remember of the Great Depression? 23:49

- How did Vernon come to create the field of experimental economics? 28:04

- The secret to a perfect hamburger. 38:21

- Markets for perishables vs. markets for long-lived durables. 41:07

- How credit makes bubbles bigger. 45:45

- The psychology of housing bubbles. 55:10

- When did the US housing bubble begin? 1:01:49

- How do housing bubbles end? 1:11:32

- The macroeconomic consequences of housing busts. 1:24:48

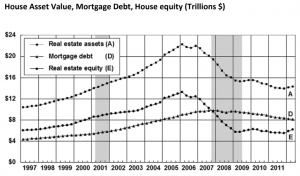

- Household balance sheets. 1:30:54

- What happens when someone falls into negative equity? 1:36:27

- The effect of negative equity on consumption. 1:42:15

- The construction cycle vs. the price cycle. 1:47:14

- Australia’s housing market. 1:48:33

- Rethinking the Great Depression. 2:01:59

- Australia’s 1890s depression. 2:14:03