#79: On Radical Uncertainty, "Phantastic Objects", and Blowing Bubbles – David Tuckett

2 min read

David Tuckett is a psychoanalyst, Professor, and Director of the Centre for the Study of Decision-Making Uncertainty at University College London. He founded a new field of research known as “emotional finance”.

Show notes

Selected links

- Follow David: Website | Twitter

- Minding the Markets, by David Tuckett

- Risk, Uncertainty and Profit, by Frank Knight

- The Poverty of Historicism, by Karl Popper

- ‘The role of emotions in financial decisions’, 2012 Nicholas Barbon Lecture by David Tuckett

- ‘The role of conviction and narrative in decision-making under radical uncertainty’, 2017 paper by David Tuckett introducing “Conviction Narrative Theory”

- Uncertain Futures, by Jens Beckert

- Irrational Exuberance, by Robert Shiller

- Dymphna Boholt’s property podcast

- Aussie Home Loans’ extrapolated median house values by 2043 report

- A Crisis of Beliefs, by Shleifer and Gennaioli

- ‘Extensional Versus Intuitive Reasoning: The Conjunction Fallacy in Probability Judgment’, 1983 paper by Tversky and Kahneman that reports the “Linda problem”

- Rage Inside the Machine, by Robert Smith

- The General Theory of Employment, Interest, and Money, by John Maynard Keynes

- Descartes’ Error, by Antonio Damasio

- Narrative Economics, by Robert Shiller

- ‘Narrative Economics’, Robert Shiller’s 2017 presidential address to the AEA

- The Foundations of Statistics, by Leonard Savage

- ‘Tracking phantastic objects: A computer algorithmic investigation of narrative evolution in unstructured data’, 2014 paper by David Tuckett et al

- ‘Do Gun Buybacks Save Lives?’, paper by Andrew Leigh and Christine Neill

- ‘Recourse and Residential Mortgage Default: Theory and Evidence from U.S. States’, working paper by the Richmond Fed

- A Short History of Financial Euphoria, by John Kenneth Galbraith

- ‘The Housing Market and the Economy’, 2019 speech by Philip Lowe

Topics discussed

- What do modern psychoanalysts do? And David’s journey to founding “emotional finance”. 4:37

- Knightian uncertainty. 9:52

- Why is the future fundamentally uncertain? 14:20

- Does a world of Knightian uncertainty give us carte blanche to believe whatever we want to about fundamentals? 22:18

- Are extrapolative claims peddled by Australian property gurus in any sense “irrational”? 31:18

- The great rationality debate and the (limited) contributions of behavioural economics. 40:46

- The role of emotions in financial decision-making. 57:25

- Asian buyers narrative in the Australian housing market. 1:06:36

- What is a “narrative” in the context of market fundamentals? 1:12:18

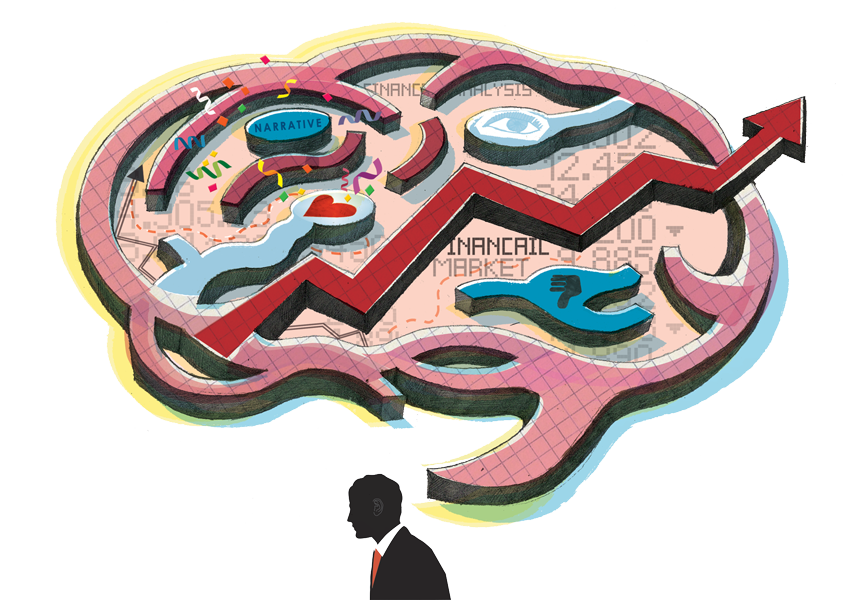

- “Phantastic objects” and how to find them. 1:25:19

- “Divided states”. 1:36:14

- Not groupthink, but groupfeel. 1:45:00

- Joe’s statistically insignificant theory about housing bubble bears. 1:52:26

- A heuristic for spotting when the market views something as a phantastic object. 1:58:51

- The anatomy of a bubble. 2:00:41

- Houses as phantastic objects. 2:02:33

- How small groups of fanatics can blow bubbles. 2:09:41

- What should policy-makers and central bankers take from David’s research? 2:13:52